Identify What Point Will Eventually Be Reached if Companies Continue Adding Workers

Shutdown Point

An operating level where a business does not benefit in continuing production operations in the short run

What is a Shutdown Point?

A shutdown point is an operating level where a business does not benefit in continuing production operations in the short run when revenue from selling their product is unable to cover variable costs of production. The shutdown point represents a point where a firm will incur higher and increasing losses if it continues production, as opposed to reduced losses if production is ceased. The shutdown point occurs at a point where marginal profit reaches a negative scale.

Understanding Shutdown Points

A shutdown arises when price or average revenue (AR) falls below average variable cost (AVC) at the profit-maximizing output level. Continued production will incur additional variable costs but will not generate enough revenue to cover them. At the same time, the firm will still have fixed costs to pay, further increasing the losses.

A shutdown point is typically a short-run position; however, in the long run, the firm should shut down and leave the industry if its product price is less than its average total cost. Therefore, there are two shutdown points for a firm – in the short run and the long run. The decision to shut down is dependent on which costs the firm can avoid by shutting down production. The short run is a period where at least one of the firm's inputs is fixed, resulting in fixed costs incurred despite the decision to shut down.

In summary, the shutdown point has the following characteristics:

- It is the output and price point where a firm is able to just cover its total variable cost.

- The average variable cost (AVC) is at its minimum point.

- It is where the marginal cost (MC) curve intercepts the average variable cost (AVC) curve.

- The firm is indifferent between shutting down and continuing production where losses equal to the total fixed costs are incurred regardless of either decision.

Shutdown Point Diagram

Where:

- MC – Marginal Cost

- ATC – Average Total Cost

- AVC – Average Variable Cost

- SP – Shutdown Price

- BEP – Break-even Price

Short-Run Shutdown Decision

The cost of production is divided into two parts – fixed costs and variable costs. The break-even point is a point where revenue generated from sales of a product is equal to the production cost (fixed cost plus variable cost). Zero profit is generated at the break-even point. On the graph above, it is the point where the average total cost (ATC) is equal to marginal cost (MC) (i.e., MC = ATC). Marginal cost equals a change in total costs for each additional unit produced. Fixed costs do not change in the short run; hence, the change in total costs refers to variable cost only.

The shutdown zone represents an area between the break-even point and the shutdown point. it is an area where production can continue, as average revenue (AR) will still be able to cover average variable cost (AVC). However, in the shutdown zone, the firm will be making losses as the price is below average total cost (ATC). The firm operates at any level above the AVC curve as long as it is where MC = MR (price). The MC curve above the AVC is also the short-run supply curve of the firm.

The shutdown rule states that a firm should continue operations as long as the price (average revenue) is able to cover average variable costs. The firm can continue operating, as it will be producing where marginal revenue (price, average revenue) is equal to marginal cost, a condition that ensures profit maximization or loss minimization.

A continuation of the shutdown rule states that in the short run, fixed costs are considered as sunk costs. Hence, it should not be considered in the decision of whether to shut down or continue with operations. In addition, in the short run, if the firm's total revenue is less than variable costs, the firm should shut down.

A short-run decision to shut down is not the same as exiting the industry. Several firms in seasonal industries – such as agriculture, fishing, etc. – shut down their firms during the offseason to avoid unnecessary operating costs. They will not be generating any revenue during the off-season; hence they are unable to cover variable costs arising. It makes sense to temporarily shut down until the upcoming season commences.

Shutdown Point Illustration

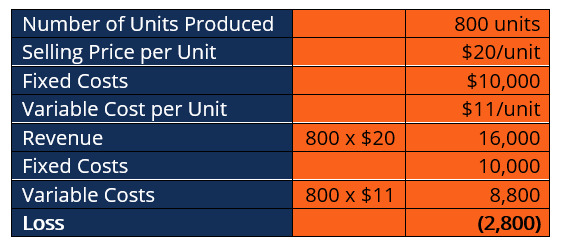

Enderby Manufacturing's production details are as follows:

Enderby Manufacturing is operating at a loss of $2,800. The firm cannot avoid paying fixed costs, whether they operate or not. If they choose to shut down and cease operations, they will generate zero revenue, zero variable costs, and incur fixed costs of $10,000, which means the total loss will increase to $10,000.

However, if the firm continues to operate, it will still generate revenue of $16,000, where $8,800 will be expended to cover variable costs, and the balance of $7,200 will meet part of the fixed costs. Therefore, by continuing operations, the firm will only make a loss of $2,800 instead of $10,000 if they decide to shut down in the short run.

However, if the selling price falls below $11 per unit and costs remain the same, the firm will have reached the shutdown point (AR < AVC). Such a condition satisfies the shutdown rule where shutdown is recommended.

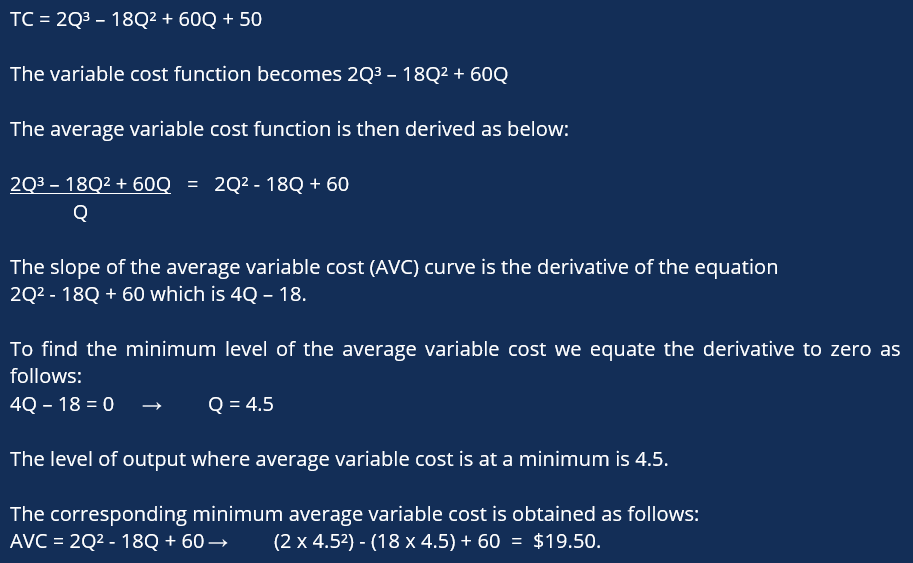

Calculation of the Short-Run Shutdown Point

As illustrated above, the shutdown point is the output level at the minimum of the average variable cost curve (AVC).

The shutdown point can be calculated using the total cost (TC) function. Suppose the total cost function is as follows:

Long-Run Shutdown (Industry Exit)

As a rule of thumb, a decision to shut down in the long run – i.e., exiting the industry – should only be undertaken if revenues are unable to cover total costs. It means in the long run, a firm making losses should shut down permanently and exit the industry. The short run is defined as a period where at least one fixed input or cost is present in the business. Fixed expenses such as rentals are incurred whether the firm undertakes production or not. In the long run, all inputs and costs are variable.

However, in the long run, if the firm is unable to raise the selling price per unit (to increase overall revenue) to cover total costs, the losses will continue ballooning until average revenue (AR) is exceeded by the average total cost (ATC). The firm will have reached the shutdown point where the only viable option is to shut down.

Shutdown, as indicated above, is a short-run decision to minimize losses. It is because a firm can shut down in the interim, but if market conditions permit, it can still resume production. Even if the firm shuts down, it will still have incurred sunk costs in terms of investment in plant and equipment. Hence, it is possible for a firm to shut down in the short run and resume production in the long run.

However, if conditions do not improve, firms will resultantly decide to exit the industry, which is a long-run decision. The long-run exit decision is guided by the relationship between the price (P) and the long-run average cost (LRAC). Firms will exit the industry if P < LRAC. In the long run, if the firm decides to operate, it will still operate where the long-run marginal cost (LRMC) is equal to marginal revenue (MR).

The long-run shutdown point is defined by the output corresponding to the minimum average total cost (ATC). The long-run shutdown point can be calculated much the same way we did for the short-run shutdown point. We take the derivative of the ATC and solve for Q by setting it to zero. We plug it into the ATC function to get the price.

Monopoly Market Structure Shutdown Point

In the short run, a monopolist market structure shutdown point is reached when average revenue (price) is below average variable cost (AVC) at every output level. In such a case, it means that the demand curve is completely below the average variable cost curve.

Even though a firm may be producing where marginal revenue is equal to marginal cost (MR = MC: the profit-maximizing level of output), average revenue would be less than average variable cost. The monopolist would be wise to shut down at such a point.

Real-World Application of the Shutdown Point

There are circumstances where firms can reach a shutdown point where the price is below AVC, but they decide not to shut down and keep operating because of any of the following reasons:

- To retain long-term customers of the business. When a firm thinks that they are in a passing period of falling demand, they can opt to keep producing.

- Some financially-strong firms are able to ride out a period of loss-making due to readily available credit support or a healthy standby reserve fund.

- Firms can also decide to cut costs or increase product prices if they reach the shutdown point.

- Firms can also shut down and leave the industry if they perceive a gloomy forecast of the long-term performance of the industry. It can happen well before the firm reaches the shutdown point – i.e., where AR < AVC.

- Firms can also continue operating past the shutdown point, as it may take time to realize that they are operating at a loss. They may find out through management accounts once they are released.

Additional Resources

Thank you for reading CFI's guide to Shutdown Point. To keep advancing your career, the additional resources below will be useful:

- Long-Run Supply

- Marginal Revenue

- Operating Expenses

- Point of Diminishing Returns

shafferdentrejecome.blogspot.com

Source: https://corporatefinanceinstitute.com/resources/knowledge/strategy/shutdown-point/

0 Response to "Identify What Point Will Eventually Be Reached if Companies Continue Adding Workers"

Postar um comentário